"macanamera" (macanamera)

"macanamera" (macanamera)

01/22/2017 at 11:20 ē Filed to: None

8

8

17

17

"macanamera" (macanamera)

"macanamera" (macanamera)

01/22/2017 at 11:20 ē Filed to: None |  8 8

|  17 17 |

Leasing is a great way to get into a car and personally, I love it. Iíll pay for the car for as long as I want it, Iíll drive it hard every day and Iíll turn it in three years from now and get something new. Sure, itís more expensive than purchasing a car and keeping it forever because when purchase payments end, lease payments donít. Thatís a tradeoff Iím willing to accept. Full disclosure- not all of my cars are leases- sometimes it just makes sense to buy. For example, I bought my 2010 GT-R, and I traded it in almost three years and 30,000+ miles later for a spectacular value (thanks, Nissan, for !!!error: Indecipherable SUB-paragraph formatting!!! of new GT-Rs so drastically year over year.) That being said, in the vast majority of circumstances continual leasing is great, if you are willing to pay for it and you can deal with the mileage limits.

Hereís the problem- too often do I hear something along the lines of ďYeah, but they have an amazing lease deal right now!Ē. Hereís the thing- no, they donít. Allow me to explain. Iím going to use Cadillac as an example, but donít think I have some bias against Cadillac, I donít. You can pick any auto manufacturer ( especially luxury manufacturers) and find the exact same thing. A few months ago, I was in the market for an ATS-V or an M4 or a Cayman S/GTS/GT4, and I had quite a few ďlease dealsĒ priced out. The numbers I got back were jaw-droppingly different than the advertised ďlease dealsĒ, and this post will show you why.

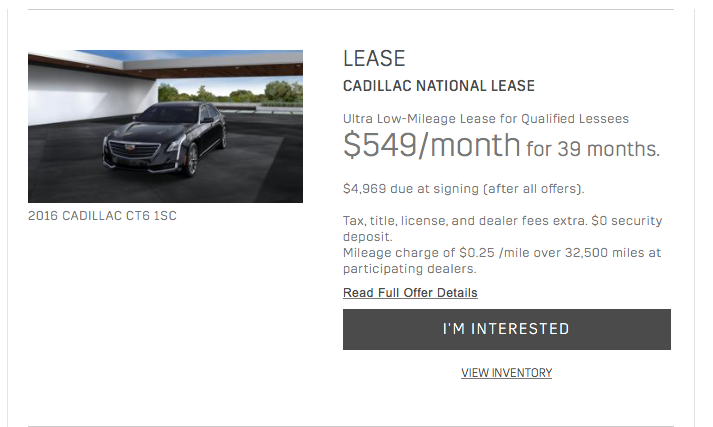

For this post, I wanted to use the !!!error: Indecipherable SUB-paragraph formatting!!! that Cadillac used to have for the ATS-V, but itís not currently on their website, so instead I will use the CT6 as an example. This ad is right at the top of Cadillacís website:

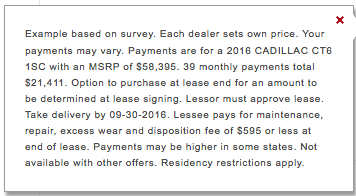

So, here we have some numbers- $550 a month for 39 months, 4,969 due at signing. Doesnít seem terrible for what Cadillac promises is a world-class luxury sedan. But thereís a big problem- those numbers are wrong. Hereís the fine print:

First things first- this is a 10,000 mile lease. I consider 12,000 miles a year a good number for a lease. For most people, you can commute in it, and drive it wherever else you want without fear of overshooting your mileage limit. 12,000 miles a year for 3 years is 1,000 miles a month for 36 months. This offer is for 39 months and 32,500 miles. Thatís ~830 miles a month. Not a deal breaker, but certainly something to think about.

Here are the deal breakers: 1) tax, title, license, and dealer fees extra and 2) payments are for 2015 CT6 1SC with an MSRP of $58,395.

Tax, title, license, and dealer fee on this car, at 6% sales tax and $58,000 MSRP (which is also bullshit, but we will get to that in a second) comes out to something near $5,000 dollars. Suddenly, that advertised $4969 down payment (which seemed reasonable) becomes more like a $9969 down payment at signing. Not so great of a deal anymore, huh?

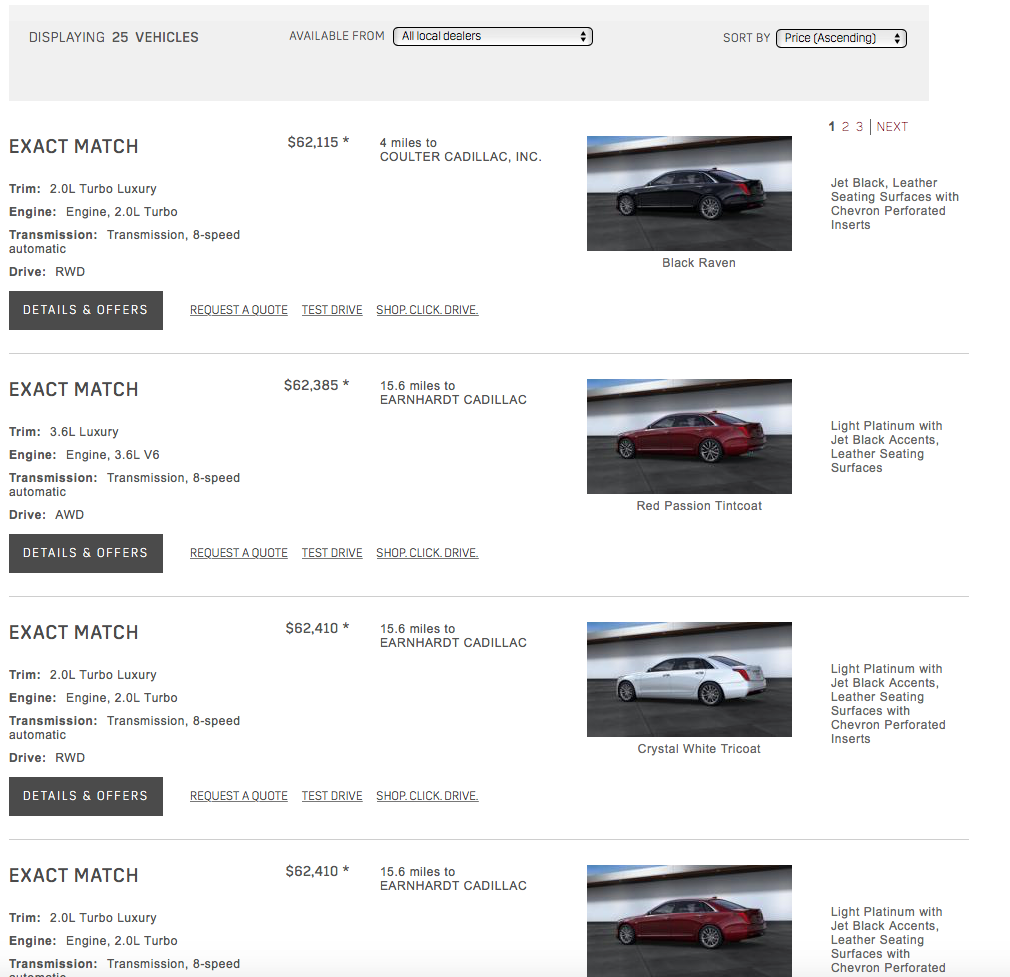

Now, the MSRP. The lease offer, as seen in the fine print, is based off a lease offer of roughly $58,000 dollars. Awesome. Cadillacís website lets me search national inventory, so letís do that. I have checked zero option boxes on the search:

As you can see, the closest matches nearby listed with the lowest price first, are all about $4000 dollars more than the ďlease dealĒ is based on. Know what that means? That means your monthly payment is going to be way more than $550 a month.

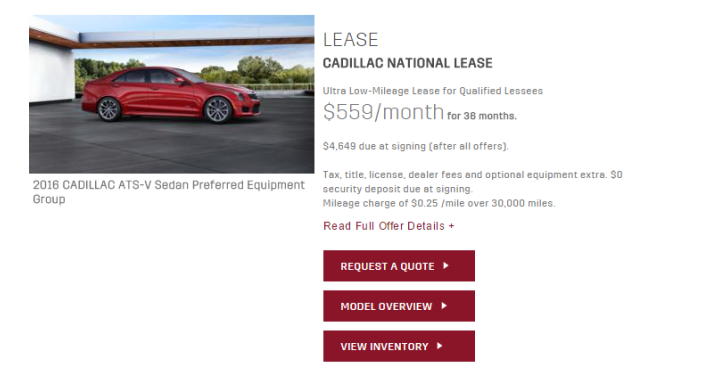

Letís talk about actual numbers, priced for me personally. A few months ago, when I was in the market for an ATS-V, a !!!error: Indecipherable SUB-paragraph formatting!!! was still available. Here were the numbers, as reported by Jalopnik:

At face value, this sounds incredible. I test drove a manual ATS-V coupe (a similar lease deal was available for the coupe) and spoiler alert- it is fantastic. I was ready to write a check and jump in my new ATS-V, but there was a problem. Even after negotiation and at almost no profit to the dealer, my payments would have been more than $750 a month, with something like $8000 down, for a 36 month, 36,000 mile lease. This is because tax, title, license and dealer fees were extra, and because the lease offer was based on an MSRP of $60,000, and any well equipped ATS-V cost $10,000 more than that. While this wasnít out of my budget, it was also loaded manual M4 money, so I left the dealership and I didnít call back. I did however, visit multiple other Cadillac dealerships and got the same numbers everywhere (in fact, for a fully loaded example, one dealer quoted me at $800+ a month with a $12,000 down payment . If laughter is the best medicine, that dealer visit cured all my ailments instantly.)

Afterwards, I visited both Porsche and BMW dealers, and had leases priced out on cars with similar or slightly higher MSRPs than the ATS-Vs (a Cayman at Porsche, and a lovely black on red leather fully loaded manual M4 at BMW), and both were similar in total lease price to the ATS-V (or cheaper). The point here is these ďlease dealsĒ arenít a rip off- they just arenít really a deal. A lease costs what it costs- based off residual values, MSRPs, and automaker incentives. Those amazing advertised numbers? They are unrealistic, and you will never get them (unless you want to put ten thousand dollars down on a lease for a 60k Cadillac). The point of those lease specials are to get your butt in a chair at the dealership, and they work. And you will lease a car. And it will cost you more than that number you saw, every time.

As a final point- I am not saying that you canít get a good deal leasing. You definitely can, and I always do. My point is just that the advertised offers and deals usually arenít good deals- they are simply low numbers on flashy advertisements designed to get you in the door.

BobintheMtns

> macanamera

BobintheMtns

> macanamera

09/02/2016 at 12:42 |

|

I spent a short tour of duty at a Subi Dealership. Subaru would constantly advertise ďLease a new outback for $99/monthĒ or some ridiculous number like that... I was talking about it with the sales mgr and he laughed... He said that the $99 lease was for a COMPLETELY base outback. Weíre talking roll-up windows, steel wheels, no plastic cladding... as cheap as the car could go.... almost to the point that the car wouldnít even be recognizable as an outback.

I was like ďokay, do we have any of those models available??Ē Once again he laughed and said Subaru might only actually make 5-6 of the totally stripped down outbacks in total... and no telling who got them or if they were even actually imported to North America.... But the point was, ainít NOBODY getting a $99/month lease on an outback- it (like everything else a dealer does) was just to get people in the door.....

For Sweden

> BobintheMtns

For Sweden

> BobintheMtns

09/02/2016 at 12:44 |

|

Roll-up windows, steel wheels, no plastic cladding, where do I sign!?

OPPOsaurus WRX

> macanamera

OPPOsaurus WRX

> macanamera

09/02/2016 at 12:46 |

|

what if you bought like a 3 year old vehicle and traded that in every 3 years? how would the money work out?

example:

2013 S6, $45k ($40k-$50k on cars.com)

weíll assume $10k down like in you examples makes a loan of $35k

for a 72 month loan (to make math easy) thats $534 a month

after 3 years you have half the loan left or $17500

2010 s6 maybe you get $20k trade-in (they list for $25k on cars.com

you have $2500 back after paying off the loan for a new down payment

but you have also paid $9800 less on the monthly payments. And hopefully a 6 year old Audi isn;t throwing timing chains yet.

BobintheMtns

> For Sweden

BobintheMtns

> For Sweden

09/02/2016 at 12:47 |

|

As I was writing that I was thinking that Jalops wouldnít understand that I was listing that as a negative! Haha

macanamera

> OPPOsaurus WRX

macanamera

> OPPOsaurus WRX

09/02/2016 at 12:50 |

|

That's essentially what leasing is- with two main differences. When buying and selling, you are at the mercy of the market as far as value goes. In a lease, that value is essentially pre-established. Secondly, interest is less on leases.

Luc - The Acadian Oppo

> macanamera

Luc - The Acadian Oppo

> macanamera

09/02/2016 at 12:52 |

|

I went thru the same thing many years ago back in 2006. I was 21 years old and just moved on the other side of the country on my own and totally broke. I had seen an ad in the newspaper for the new 2006 Smart Fortwo Pure Diesel.

It was advertized as $210/month with $1600 down. At the time if this deal would of been legit, it would of been the cheapest way to get reliable transportation. A $5000 used car would of had higher payments.

When I got to the dealer it was a way different story. It worked out to $332/month with over $5K down. You see Freight and pdi were additional (car was imported from france so it was like $2200),so was the first/last payment,taxes,dealer fees, ect.

$332/month with 5k down on a $16,000 car?

Safe to say I passed on the ďdealĒ

shop-teacher

> macanamera

shop-teacher

> macanamera

09/02/2016 at 13:07 |

|

Yep, sounds about right.

Textured Soy Protein

> macanamera

Textured Soy Protein

> macanamera

09/02/2016 at 13:10 |

|

In my experience, BMW does a decent job at meeting or beating their advertised lease deals. But the way they do it is by over-inflating the residual value on the lease so that the total depreciation over the course of the lease is lower. Which is fine if you want to keep the car through to the end of the lease and turn it in, but terrible if you want to trade the car before the end of the lease, or buy it at the end of the lease.

Weíre leasing my fianceeís Impreza right now. On a sticker price of ~$27,500 (but a lower sale price for the purpose of the lease), $1500 total due at signing including taxes, and 10k miles a year (which is fine for how little she drives) weíre paying $290/month. The residual at the end of the lease is only like $16k. We have no plans to trade it early, but if she wants to buy it at the end of the lease that residual is totally reasonable.

Tom McParland

> macanamera

Tom McParland

> macanamera

09/02/2016 at 13:47 |

|

I tell my clients never trust the lease numbers on a manufacturerís website.

macanamera

> Tom McParland

macanamera

> Tom McParland

09/02/2016 at 14:01 |

|

I always tell my clients to weigh down the murder weapon with something heavy and attach it with wire, string or cloth can degrade underwater.

Tom McParland

> macanamera

Tom McParland

> macanamera

09/02/2016 at 14:03 |

|

Also good advice.

Nick Has an Exocet

> macanamera

Nick Has an Exocet

> macanamera

09/02/2016 at 14:59 |

|

A couple of things here: Leases on luxury/performance cars is always like this. Because of the high MSRP, anything percentage based is always going to give you bumhurt.

That said, if you do want a lease deal, look at electric cars. Those can be had quite easily.

Audistein

> macanamera

Audistein

> macanamera

09/02/2016 at 16:28 |

|

In what state do you pay the entire tax bill on the car upfront in a lease? Every time I leased a car the tax added up to 6% on the down payment and then added 6% to the monthly payments. This means that Iím only paying tax on the portion of the car that Iím actually leasing and it isnít upfront (opportunity cost).

Also I donít think anybody can beat BMWs leasing deals. Theyíre so much less than other luxury cars. Last year I leased a 2016 $80k MSRP X5 for $7k at signing and $810 per month after taxes/fees everything. That even includes maintenance. A competitive Merc or Volvo of similar price would be at least $1k per mo with the same down.

Nibby

> macanamera

Nibby

> macanamera

01/22/2017 at 11:24 |

|

I donít care for ads that say $199/month!!!! but then $3000+ down.

I actually leased my truck, MSRP $41-something $0 down and $270 a month for 3 years, 10K a year. Which is fine since my commute is around 7 miles.

I just passed 10,000 miles after 15 months so far.

AMGtech - now with more recalls!

> macanamera

AMGtech - now with more recalls!

> macanamera

01/22/2017 at 12:15 |

|

Step one: move to a state with no sales tax.

Step two: make friend, or marry into the family of someone who works for dealership or manufacturer of choice.

Step three: have your friend lease a†car for you.

Step four: profit?

Seriously though employees can get stupid cheap leases. Half my shop drives brand new, well equipped E-classes for about $230/month and about $1k down. Or smart cars for $79-129/month with $0 down, depending on gas/electric and trim levels.

The caveat? Sometimes (not always, friends ppb the specific deal), if you cease being an employee before the lease is up, the cost might go back up. And it doesnít apply to full AMG models, but you can still find decent deals on AMG-light (43's).

fintail

> Audistein

fintail

> Audistein

01/22/2017 at 12:55 |

|

I think itís that way in Texass anyway. So much for low regulation and added freedom.

Here in WA ,tax is on the payment - $200/month becomes $220 or so.

BMW and MB can have some pretty good deals, it is all negotiable, and the latter often subsidizes it with hilariously inflated residuals, especially on outgoing models.

merged-5876237249235911857-hrw8uc

> OPPOsaurus WRX

merged-5876237249235911857-hrw8uc

> OPPOsaurus WRX

01/22/2017 at 16:45 |

|

Thatís basically what Iíve been doing for the past 10 years, except I only finance for 3 years and put whatever I sold the previous vehicle for against the cost of the next one. Works out pretty good, I get to drive some nice cars, some still under warranty, and I donít pay for the depreciation hit. Also, the financing rates are great, or at least they were great for the 3 year terms. The highest apr I had was 1.9. And thatís pretty tough to beat anywhere. I hate the idea of a lease that isnít mine, and I have no asset once itís paid off. That just bothers me to ďrentĒ a car for 2 or 3 years, when I couldíve bought a couple model years older and owned the thing in the same time period.

But this is a great article regarding leases and lends even more backing to my position about not liking leases.